Save: A FinTech Startup Too Good To Be True?

Risks and Downsides of the Save “Market Savings” Product

Save (https://joinsave.com/) is a FinTech startup that claims to offer a risk-free investment opportunity with returns that are on par with the stock market. Any new investment product claiming to be “risk free” ought to attract skepticism, but there has been very little press/blog coverage of Save, and none of it has been critical.

In this blog post I’ll summarize the due diligence that I did before choosing whether to invest my own funds with Save. In the end, I did make a small Market Savings investment, but I limited the invested amount due to some lingering skepticism of Save’s business model and their underlying deposit insurance.

Table of Contents:

My Save Referral Link

Concern #1: Save’s Business Model Doesn’t Sound Sustainable

Concern #2: If Save Goes Bankrupt, Is My Money Safe?

Concern #3: You Can’t Invest Very Aggressively through Save Market Savings

Concern #4: It Seems Like Save May Be Reporting Inflated Investment Gains

What About the Save Wealth Card?

Conclusion - and My Save Referral Link Again

A Quick Disclaimer:

I’m not a lawyer or financial expert. I am very much an amateur. Please take everything I’m writing here with a grain of salt. If anyone from Save reads this and notices errors in my analysis, please do reach out.

My Save Referral Link

If you choose to invest at Save, and if you feel that this post was helpful to you in making your decision, I’d be grateful if you’d use my Save referral link here.

Concern #1: Save’s Business Model Doesn’t Sound Sustainable

Save promises to invest your money over the course of a 1 or 5 year term. At the end of the investment term, if your investment was profitable, they charge you a fee of 0.35%. On the other hand, if your investment loses money, Save evidently digs into their own funds to cover the loss and make you whole.

So far as I can tell, Save’s only source of true profit is their 0.35% fee. If you dig into their FAQ you’ll find that they also mention earning money from the interest on your deposit, but I suggest we ignore that since they presumably forgo interest income on the equivalent amount of capital that they put up in order to fund your “equivalent portfolio investment.”

My primary concern with Save is that the 0.35% fee revenue collected in good years seems insufficient to cover the money that they’re obligated to burn covering customer investment losses in bad years.

Here’s the math on that:

We can expect Save to make the most profit from customers who choose to invest in their “Conservative” portfolio. Compared to the riskier “moderate” and “growth” portfolios, the conservative portfolio ought to have fewer down years, and those down years ought to involve smaller losses. So, we’ll analyze the conservative portfolio as Save’s “best case scenario”.

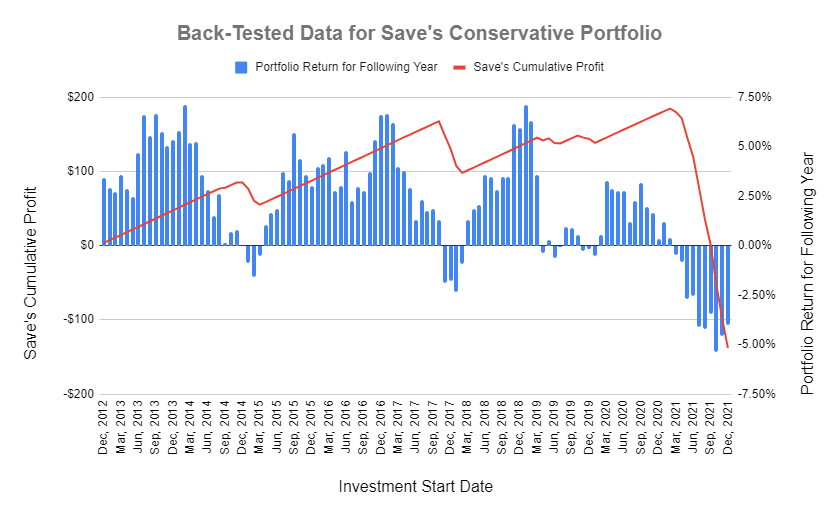

Looking at the 10 years of back-tested data that Save provides for their portfolios, let’s imagine that - at the start of every month between December 2012 and December 2021 - Save gained a new customer who made a fresh deposit of $1,000 on a 1 year term within the conservative portfolio. 108 separate investments in total. Crunching the numbers, we can see that most of these investments (85 out of the 108) yield a small profit for Save and the customer, as we would expect. However, the other 23 loss-making investments force Save to spend so much money covering losses that it wipes out their profits from the profitable investments - particularly in the last 3 years. Over the course of this 9 year period, Save would have lost about $1 on average for every $1,000 that customers invested. You can check my math in this Google Sheet.

Again, these numbers are based on the portfolio choice that ought to yield Save’s most profitable customers.

Just to clarify, I’m speaking here of Save’s profit and loss. Assuming Save kept their word, no customers would have lost money during this time period. 85 of them would have turned a profit on their investment, while the other 23 would have gotten back exactly the amount that they put in. The average annual return for customers would have been something like 2.3%.

All of this is to say that I worry about the long term sustainability of Save’s business model. There are potential explanations for the problem I’ve described above, but it seems quite possible that they might run out of money at some point and go out of business - particularly if the market takes a turn for the worse. So the next question is: what happens to your money if Save declares bankruptcy?

Concern #2: If Save Goes Bankrupt, Is My Money Safe?

According to Save, the answer to this question is “absolutely.” I’ve gone for a dive into the terms and conditions, and I think this is probably true, though it’s difficult for me to say with certainty.

Save claims that they insulate your money from risk through the following system:

When you sign up, you give Save written authorization to open a bank account at Webster Bank on your behalf. The monthly statements that I’ve received from Save refer to this as my “checking account.”

Save deposits your initial investment (the “principal”) into that account and leaves it there. Aside from deducting their 0.35% fee, they do not touch the principal until it’s withdrawn at the end of the investment term.

Simultaneously, they open a brokerage account - also in your name - at Apex Clearinghouse. From their own funds, Save loads this account with the same amount of money as the principal that you put into the bank account at Webster.

Save invests the Apex Clearinghouse money in the market (bonds, stocks, etc.) according to whichever investment strategy you chose when you signed up.

At the end of the investment term, Save returns all of your principal and any gains made in the Apex Clearinghouse account, minus their fee.

Webster Bank is FDIC insured, so if Webster goes bankrupt the federal government will make you whole.

What happens if Save goes bankrupt? This is the possibility that leaves me slightly concerned. Is there a chance that Save’s creditors might argue that they’re entitled to a portion of customer deposits?

My guess is no, but I can’t say with certainty. My “checking account” through Save is presumably in my name. Save’s terms and conditions say that I am the “owner” of the account, and they are only able to control the account as my “agent.”

On the other hand, even though the Webster Bank account is in my name, Save is the only one that can actually do anything with it. I don’t get a login for Webster’s online banking portal. If I want to withdraw my money, I need to ask Save to do it for me, and they won’t give it to me without taking their fee first. All the earned interest on my deposited money goes to Save. Perhaps in a bankruptcy, Save’s creditors could argue that my account at Webster is a flimsy legal artifice intended to disguise the reality that Save is the true custodian of my funds? In that case, could the courts lump my investment in with Save’s other assets, and leave me to be considered just one more unsecured creditor getting back pennies on the dollar?

One example that I find reassuring: the cryptocurrency exchange Voyager Digital went bankrupt in July 2022 and briefly forbade customers from withdrawing the USD that they had deposited with them. By August though, a judge had agreed that Voyager’s banking arrangements had properly isolated customer cash deposits from Voyager’s own assets, and that the customer USD deposits were thus protected from the other creditors in the bankruptcy. Customers did get all that money back (I’m speaking here only of the cash they deposited - the cryptocurrency they had on the exchange is another story). I am hopeful that the same would happen if Save went bankrupt.

Concern #3: You Can’t Invest Very Aggressively through Save Market Savings

When you invest funds into a Save Market Savings program, you’re offered a relatively limited selection of portfolios to invest in. Save will recommend a portfolio to you based on your risk tolerance (“conservative,” “moderate,” or “growth”), or an “ESG” portfolio. There’s no ability to choose individual stocks or investment category mixes within these portfolios.

The portfolios can be opaque - particularly the “Global Multi-Strategy” portfolio that Save recommends for investors who request the most aggressive “growth” option. Save wrote a rather lengthy blog post explaining the management scheme for this portfolio here.

It’s worth noting that Save’s own “hypothetical back-testing” for the Global Multi-Strategy portfolio claims that it would have returned an average of roughly 6% per year over the 10 year period between December 2011 and December 2021 - even accounting for them making up your losses in down years. I’d suggest that this represents a relatively low rate of return for a portfolio that is intended to seek returns aggressively. A simple S&P 500 index fund would have returned approximately 17% per year over that same 10 year period. In 2023, 6% is barely higher than the guaranteed return that you can earn on an ordinary Savings account at a traditional bank.

However, since Save is promising to cover your losses, Save is specifically incentivized to discourage you from investing in “high risk high reward” assets. The price they pay when you lose money is much larger than the small fee they earn when your portfolio experiences gains. They’d prefer that you have 10 years of consistent 6% gains instead of 9 years of 12% average gains followed by 1 year of 12% loss - even though the latter strategy would be much better for you as a long-term investor.

I’ll also highlight that - according to Save’s hypothetical back-testing - the Global Multi-Strategy portfolio would not have had a single down year in any of the last 10 years. You can see this in their chart below. That’s pretty remarkable, and would be good news for both Save and for customers, but I can’t help but fear that it sounds a bit unlikely? Can such a track record truly be sustained? And how reliable can the back-testing be for a strategy this complicated?

Concern #4: It Seems Like Save May Be Reporting Inflated Investment Gains

I noticed something suspicious when I invested with Save. I made my investment on January 11, 2023. When I checked the app two days later (January 13, 2023), it indicated that my investment had already appreciated by 12%. Needless to say, appreciation of 12% in two days seemed highly unlikely.

Instead, it appeared to be a bug in the app. Save had deducted $612 from my account and then issued me a “rebate” for that same amount. The $612 comprised approximately 12% of the funds I had deposited, and thus the Save app claimed (incorrectly) that my investment had already turned a profit of 12%.

Before writing this post, I reached out to Save’s customer service and they confirmed that this is indeed what happened. They also told me that the “gain” shown in the app should now be accurate, and that the “rebate” is no longer being factored in. However, the customer service agent didn’t explain why this happened in the first place or when it was resolved. To be honest, I remain concerned that the app is still showing me inflated gains.

Some Reassuring Thoughts About Save

So far I’ve focused on discussing potential red flags with the Save Market Savings program, since critical coverage has been very limited so far. In this paragraph I’ll go over some of the things that I found reassuring, and which played into my decision to ultimately make a small investment with them.

They have some legit investors. Webster Bank and BNP Paribas. Presumably those investors did some significant due-diligence and came away feeling that Save’s business model was sound. OTOH, perhaps the same could have been said for all the large institutional investors who invested in FTX before it imploded?

I made my investment at Save a few months ago, in January ‘23, and so far my experience with the app/platform has been reasonably good, aside from “concern #4”.

It’s possible that the 0.35% fee is unsustainable for Save right now, but that they’re only offering the low fee now as a “loss leader” to attract more customers, and as they grow they’ll raise the fee to something that will allow them to turn a reasonable and sustainable profit.

What About the Save Wealth Card?

This is another odd product. If readers are interested, I’d be happy to write up a post with my thoughts on it. Drop a comment here if that’s something you’d want to read.

Conclusion - and My Save Referral Link Again

That’s about it for my thoughts and research on this. If you see any errors in my understanding or analysis, don’t hesitate to shoot me an email or drop a comment here. And if you found this helpful to your decision about whether or not to invest with Save, here’s my referral link for their signup bonus.

Once you sign up, you can also share your own referral link in this Reddit thread.